1/ September marked a quieter but more efficient month for Solana.

Network reliability reached new highs, while activity and fee volume declined in tandem.

A breakdown of the key metrics shaping Solana’s on-chain landscape👇

2/ But first, a quick explainer intro.

Validators verify transactions, create blocks, and reach consensus. Slot leaders are chosen to produce blocks in assigned time slots, bundling hundreds to thousands of vote and non-vote transactions.

3/ Validators submit vote transactions to reach consensus aka to agree on what is happening in the network.

Non-vote transactions are any other kind of transaction, like a swap, a token transfer, etc.

4/ Skip rate fell from 0.60% in January to 0.07% in September, down 88% year-to-date.

September marked a 40% improvement over August, continuing the decline.

5/ Vote latency becomes more predictable as it nears the 1-slot target.

The monthly range shrank from 0.21 slots in January to 0.03 in September. Average latency reached 1.023 slots in September, down 0.5% from August.

6/ The slowest 1% of votes now land in just 1.36 slots.

P99 vote latency is down 23% since August and down 63% since January.

7/ Non-vote TPS hit yearly lows in September with 7-day rolling median at 970 and P99 at 1,300, declining 27% and 40% respectively from July's highs.

8/ Compute units per block peaked in summer before falling sharply by September.

Median blocks dropped 40%, the busiest blocks (P90) fell 20%, and the least busy blocks (P10) declined 37%.

9/ @Solana has three fee types:

base (mandatory 5,000 lamports per signature, split between validator and burn),

vote (base fees validators pay for consensus), and

priority (optional user payments for transaction priorization, 100% to validators since Feb 2025).

@solana 10/ Priority fees drove @Solana's 2024 fee explosion, surging from 115K SOL to 3.8M SOL and pushing total fees up 5.6x.

In 2025, fees are projected to remain flat year-over-year.

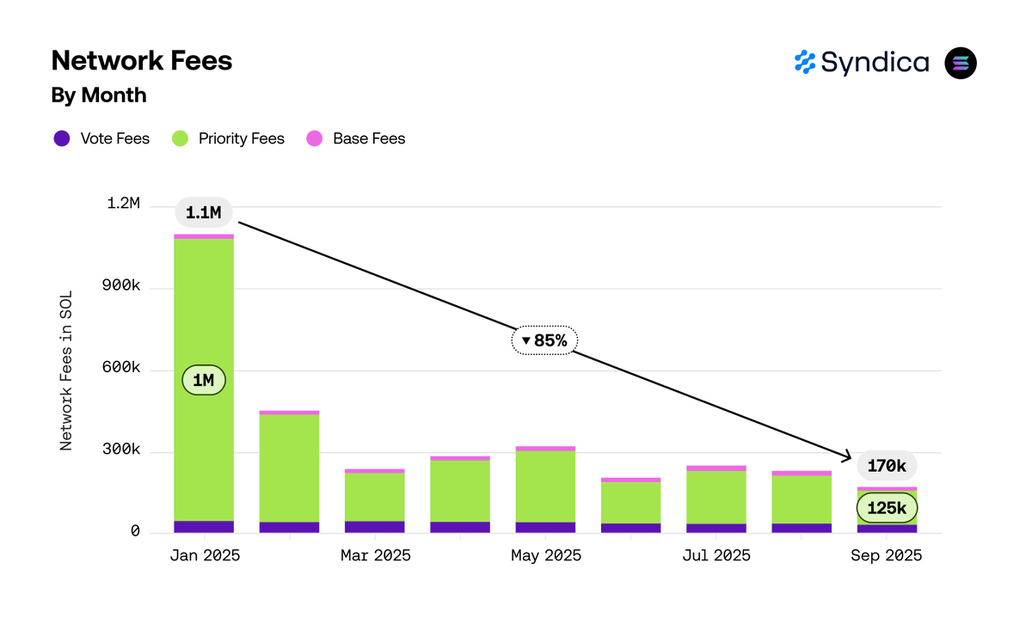

@solana 11/ September fees hit a yearly low at 170K SOL, down 85% from January's 1.1M peak. Priority fees drove the decline, falling from 1.0M to 125K SOL.

@solana 12/ Tips are extra payments made directly to validators for priority inclusion, separate from fees.

@jito_sol pioneered this by modifying the @Solana client to accept tips.

@solana @jito_sol 13/ Validator revenue shifted from fees to tips: 6% of REV in 2023, 52% in 2024, projected 61% in 2025.

REV (Real Economic Value) is a @Blockworks_ metric combining transaction fees and tips to measure blockchain demand.

@solana @jito_sol @Blockworks_ 14/ Monthly tips average $106.5M in 2025, up 50% from 2024.

Cumulative tips since January 2023 have reached $1.8B.

@solana @jito_sol @Blockworks_ 15/ @jito_sol captured $1.36B (75%) of cumulative tip revenue.

With @bloxroute's $250M, two providers control 89%. @nextblock_sol, @temporal_xyz, and @0slot_trade collectively earned $196M (11%), while six smaller providers split just $6.8M (0.4%).

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade 16/ @jito_sol dominated early and maintains 61.5% by Q3 2025.

@bloxroute became the first major rival, reaching 20% in H2 2024.

@0slot_trade surged to 21% in Q3 2025 alongside smaller providers, all competing in a declining revenue market.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade 17/ @doublezero launched on mainnet Oct. 2nd with 22% of @Solana stake.

Chain performance is increasingly network-limited, not compute-limited. DoubleZero's decentralized fiber links filter spam & route messages to reduce jitter, improving consensus w/o trusted intermediaries.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero 18/ @Solana validators can choose to run Agave (reference implementation) or Frankendancer (Agave-Firedancer hybrid), with variants like Vanilla, Jito (MEV auctions), and Paladin (sandwich protection).

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero 19/ @Solana clients ship rapidly: Agave versions turn over every 85 days on average, Frankendancer every 53 days. This contrasts with @Ethereum's Geth at 340 days and the original Solana client at 120 days.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 20/ 1 in 5 @Solana validators now run Frankendancer; from 6 validators in January to 201 by September 30.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 21/ Frankendancer's share of stake jumped to 20% in September as Agave lost ground.

Agave Jito fell to 71% and Paladin to 6% of total stake.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 22/ Frankendancer Jito leads in priority fees at 0.0245 SOL per block, 10% higher than Agave Jito and Paladin. Higher priority fees signal blocks contain a greater share of high-value user transactions.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 23/ Client priority fees converged throughout 2025. In January, Frankendancer Vanilla was 80% above Agave Vanilla and Agave Jito 40% higher. By September, the gap compressed to just 15% between Frankendancer Jito and Agave Vanilla.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 24/ Frankendancer Jito validators average higher fees (95% exceed median vs 40% for Agave).

However, the widest gaps exist within clients: all top 3 and bottom 3 performers run Agave Jito, with best earning 2.1x worst. Validator optimization can eclipse client choice.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 25/ Frankendancer Jito leads average tips per block at 0.0194 SOL, 58% above Agave Jito and Paladin.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 26/ Transaction inclusion tips declined across clients as activity waned, but Frankendancer Jito shifted from 25% behind Agave Jito in early 2025 to taking the lead in August (13% higher). By September, Frankendancer exceeded Agave Jito by 58%. Paladin tracks Agave Jito closely.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 27/ MEV tips mirror fee patterns: Frankendancer shows consistent outperformance (88% above median vs 37% Agave), but top validators run Agave Jito. Best performer: 4.5x median.

Frankendancer offers baseline edge but optimization matters most.

1,08 rb

1

Konten pada halaman ini disediakan oleh pihak ketiga. Kecuali dinyatakan lain, OKX bukanlah penulis artikel yang dikutip dan tidak mengklaim hak cipta atas materi tersebut. Konten ini disediakan hanya untuk tujuan informasi dan tidak mewakili pandangan OKX. Konten ini tidak dimaksudkan sebagai dukungan dalam bentuk apa pun dan tidak dapat dianggap sebagai nasihat investasi atau ajakan untuk membeli atau menjual aset digital. Sejauh AI generatif digunakan untuk menyediakan ringkasan atau informasi lainnya, konten yang dihasilkan AI mungkin tidak akurat atau tidak konsisten. Silakan baca artikel yang terkait untuk informasi lebih lanjut. OKX tidak bertanggung jawab atas konten yang dihosting di situs pihak ketiga. Kepemilikan aset digital, termasuk stablecoin dan NFT, melibatkan risiko tinggi dan dapat berfluktuasi secara signifikan. Anda perlu mempertimbangkan dengan hati-hati apakah trading atau menyimpan aset digital sesuai untuk Anda dengan mempertimbangkan kondisi keuangan Anda.