1/ September marked a quieter but more efficient month for Solana.

Network reliability reached new highs, while activity and fee volume declined in tandem.

A breakdown of the key metrics shaping Solana’s on-chain landscape👇

2/ But first, a quick explainer intro.

Validators verify transactions, create blocks, and reach consensus. Slot leaders are chosen to produce blocks in assigned time slots, bundling hundreds to thousands of vote and non-vote transactions.

3/ Validators submit vote transactions to reach consensus aka to agree on what is happening in the network.

Non-vote transactions are any other kind of transaction, like a swap, a token transfer, etc.

4/ Skip rate fell from 0.60% in January to 0.07% in September, down 88% year-to-date.

September marked a 40% improvement over August, continuing the decline.

5/ Vote latency becomes more predictable as it nears the 1-slot target.

The monthly range shrank from 0.21 slots in January to 0.03 in September. Average latency reached 1.023 slots in September, down 0.5% from August.

6/ The slowest 1% of votes now land in just 1.36 slots.

P99 vote latency is down 23% since August and down 63% since January.

7/ Non-vote TPS hit yearly lows in September with 7-day rolling median at 970 and P99 at 1,300, declining 27% and 40% respectively from July's highs.

8/ Compute units per block peaked in summer before falling sharply by September.

Median blocks dropped 40%, the busiest blocks (P90) fell 20%, and the least busy blocks (P10) declined 37%.

9/ @Solana has three fee types:

base (mandatory 5,000 lamports per signature, split between validator and burn),

vote (base fees validators pay for consensus), and

priority (optional user payments for transaction priorization, 100% to validators since Feb 2025).

@solana 10/ Priority fees drove @Solana's 2024 fee explosion, surging from 115K SOL to 3.8M SOL and pushing total fees up 5.6x.

In 2025, fees are projected to remain flat year-over-year.

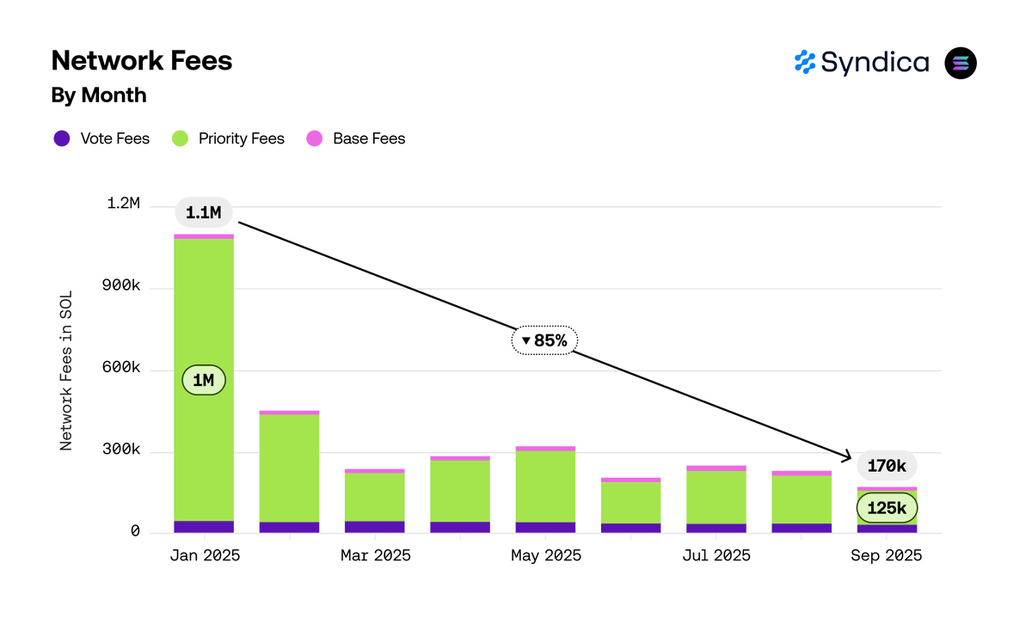

@solana 11/ September fees hit a yearly low at 170K SOL, down 85% from January's 1.1M peak. Priority fees drove the decline, falling from 1.0M to 125K SOL.

@solana 12/ Tips are extra payments made directly to validators for priority inclusion, separate from fees.

@jito_sol pioneered this by modifying the @Solana client to accept tips.

@solana @jito_sol 13/ Validator revenue shifted from fees to tips: 6% of REV in 2023, 52% in 2024, projected 61% in 2025.

REV (Real Economic Value) is a @Blockworks_ metric combining transaction fees and tips to measure blockchain demand.

@solana @jito_sol @Blockworks_ 14/ Monthly tips average $106.5M in 2025, up 50% from 2024.

Cumulative tips since January 2023 have reached $1.8B.

@solana @jito_sol @Blockworks_ 15/ @jito_sol captured $1.36B (75%) of cumulative tip revenue.

With @bloxroute's $250M, two providers control 89%. @nextblock_sol, @temporal_xyz, and @0slot_trade collectively earned $196M (11%), while six smaller providers split just $6.8M (0.4%).

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade 16/ @jito_sol dominated early and maintains 61.5% by Q3 2025.

@bloxroute became the first major rival, reaching 20% in H2 2024.

@0slot_trade surged to 21% in Q3 2025 alongside smaller providers, all competing in a declining revenue market.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade 17/ @doublezero launched on mainnet Oct. 2nd with 22% of @Solana stake.

Chain performance is increasingly network-limited, not compute-limited. DoubleZero's decentralized fiber links filter spam & route messages to reduce jitter, improving consensus w/o trusted intermediaries.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero 18/ @Solana validators can choose to run Agave (reference implementation) or Frankendancer (Agave-Firedancer hybrid), with variants like Vanilla, Jito (MEV auctions), and Paladin (sandwich protection).

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero 19/ @Solana clients ship rapidly: Agave versions turn over every 85 days on average, Frankendancer every 53 days. This contrasts with @Ethereum's Geth at 340 days and the original Solana client at 120 days.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 20/ 1 in 5 @Solana validators now run Frankendancer; from 6 validators in January to 201 by September 30.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 21/ Frankendancer's share of stake jumped to 20% in September as Agave lost ground.

Agave Jito fell to 71% and Paladin to 6% of total stake.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 22/ Frankendancer Jito leads in priority fees at 0.0245 SOL per block, 10% higher than Agave Jito and Paladin. Higher priority fees signal blocks contain a greater share of high-value user transactions.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 23/ Client priority fees converged throughout 2025. In January, Frankendancer Vanilla was 80% above Agave Vanilla and Agave Jito 40% higher. By September, the gap compressed to just 15% between Frankendancer Jito and Agave Vanilla.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 24/ Frankendancer Jito validators average higher fees (95% exceed median vs 40% for Agave).

However, the widest gaps exist within clients: all top 3 and bottom 3 performers run Agave Jito, with best earning 2.1x worst. Validator optimization can eclipse client choice.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 25/ Frankendancer Jito leads average tips per block at 0.0194 SOL, 58% above Agave Jito and Paladin.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 26/ Transaction inclusion tips declined across clients as activity waned, but Frankendancer Jito shifted from 25% behind Agave Jito in early 2025 to taking the lead in August (13% higher). By September, Frankendancer exceeded Agave Jito by 58%. Paladin tracks Agave Jito closely.

@solana @jito_sol @Blockworks_ @bloxroute @nextblock_sol @temporal_xyz @0slot_trade @doublezero @ethereum 27/ MEV tips mirror fee patterns: Frankendancer shows consistent outperformance (88% above median vs 37% Agave), but top validators run Agave Jito. Best performer: 4.5x median.

Frankendancer offers baseline edge but optimization matters most.

1,085

1

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。